CMA US

(Certtified management Accountant – United States)

Do you aspire to master financial management and enhance your job prospects, leading to a secure future?

Got questions? Everything about CMA IS mapped out for you!

- CMA US: Recognized globally by the IMA(Institute of Management accountants), it’s the top choice for finance and management accounting professionals.

- Key for MNCs & Big 4s: Want to climb the ladder of success? CMA US sets you apart in roles like financial analyst, controller, or even CFO and more.

- Quick path to success: Complete the course in just 6 to 12 months!

- Worldwide respect: With recognition in 150+ countries and 140,000+ members worldwide, CMA US opens doors everywhere.

- Unlock Global Opportunities.

- Fast-track to top job roles.

- Master Financial Strategy.

- Stand out from the crowd.

- Boost Your Earnings and ROI.

- Join a Global Network.

Your Roadmap to CMA US Certification

Wait First Check your Eligibility

Exam Eligibility

Completed high school (10+2)

Certification Eligibility:

You must have a Bachelor’s degree from any college or university.

Professional Work Experience:

Need at least 2 years of full-time work experience in management accounting or financial management. Part-time work (minimum 20 hours per week) can count too. (one year of part-time work equals half a year of full-time work).

Note:

Certification requirements come after clearing your exam, so you don’t have to worry about it now.

While an accounting background can be helpful but not required.

Discover What You'll Learn

CMA US Course Structure - 1 Level - 2 Parts - 12 Core Competencies!

Part 1

Financial Planning, Performance, and Analytics

- External Financial Reporting Decisions - 15%

- Planning, Budgeting, and Forecasting - 15%

- Performance Management- 20%

- Cost Management -15%

- Internal Controls -15%

- Technology and Analytics -15%

Part 2

Strategic Financial Management

- Corporate Finance - 20%

- External Financial Reporting Decisions - 15%

- Planning, Budgeting, and Forecasting - 15%

- Performance Management- 20%

- Cost Management -15%

- Investment Decisions -10%

Exam Overview: Everything You Need to Know!

Candidates for CMA US certification must complete all required examination parts.

Part 1

Financial Planning, Performance, and Analytics

Exam Duration: Format:

4Hours 100 MCQs & 2 Essays

Part 2

Strategic Financial Management

Exam Duration: Format:

4Hours 100 MCQs & 2 Essays

Scoring

Each MCQ carries 4 Marks

Each essay question carries 50 Marks

Maximum mark for each part: 500

Passing mark for each part: 360

Timing

3 Hours for MCQ section

1 Hour for essays

Essays presented after completing the MCQ section

Requirements

Must answer at least 50% of MCQs correctly to take essay section No option to go back to MCQ section once completed and exited

Essay Section

10-12 written response or calculation questions.Based on two scenarios depicting typical business situations.

Timing

Only basic electronic calculators allowed, limited to six functions: addition, subtraction, multiplication, division, square root, and percentage.

Requirements

Results emailed and posted online about six weeks after the testing month ends.

Timing

GAAP/IFRS changes reflected in CMA exam one year post effective date.

Scope of CMA US in India and Abroad

In India

Growing demand in finance, manufacturing, consulting, and healthcare. Preferred by MNCs, Big 4 firms, and leading Indian companies. Recognized for expertise in management accounting and finance. Competitive salaries and strong career prospects.

In Abroad

Globally recognized in 150+ countries. Valued by MNCs and financial institutions. Enables international career growth and mobility. Opens doors to diverse job markets worldwide.

Skills You’ll Develop

Financial and Managerial Skills

- Financial Analysis

- Cost Accounting

- Strategic Planning

- Performance Management

- Compliance and Ethics

- Technology Proficiency

Soft Skills Developed

- Communication

- Problem-solving

- Leadership

- Adaptability

- Critical Thinking

- Collaboration

Job Opportunities and Roles You Can Explore

An average CMA can earn up to INR 10-15 lakhs per annum, but this varies based on experience, industry, location, and specific job role. CMAs excel across diverse industries and Here's a glimpse of potential roles:

Finance

Financial Analyst, Finance Manager, Investment Banker

Manufacturing

Cost Accountant, Supply Chain Manager

Consulting

Management Consultant, Financial Consultant

Healthcare

Financial Analyst, Revenue Manager

Technology

Systems Analyst, IT Auditor

Government

Budget Analyst, Internal Auditor

Non-profit

Financial Manager, Grant Accountant

Education

Professor, Researcher

Retail

Financial Analyst, Merchandise Planner

Energy

Accountant, Risk Analyst

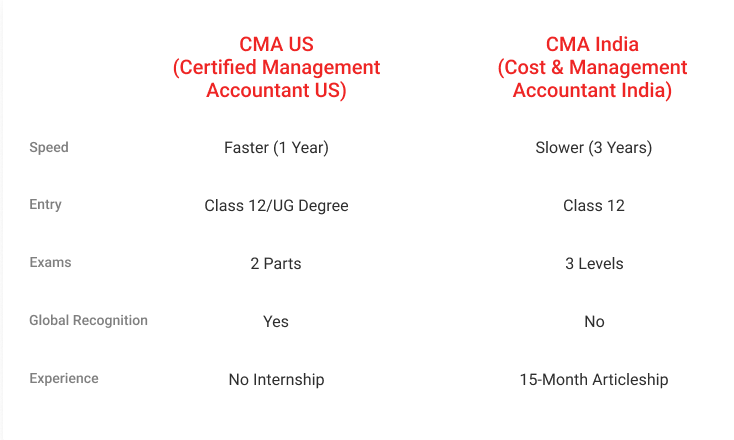

CMA US vs CMA India:

CMA US vs. Non-CMA US Salary in Asia:

Earning Potential

CMAs in Asia typically earn about 50% more than non-CMAs, leading to a significant increase in total compensation.

Median Salary

CMAs in Asia earn a median base salary of around INR 22 lakhs, while non-CMAs earn approximately INR 14 lakhs

Note: Actual salaries may vary based on factors such as experience, location, and job role. However, obtaining the CMA certification consistently demonstrates a clear advantage in earning potential within Asia.